Retirement Planning

Retirement planning shouldn’t start at retirement; it should start well before. We take a long-term view of your financial wellbeing to help create a life after work that is as well-planned as your life while working.

Investment Planning

Through developing a personalized investment strategy, diversification, and avoiding short-term distractions, we aim to help create and preserve your wealth so you reach your financial goals.

Tax Planning

It’s said that only two things are certain in life: Death...and Taxes! And while there’s not much you can do to avoid the former, with prudent planning and foresight, there’s a lot you can do to minimize the later.

Education Planning

Like Retirement Planning, which has to commence long before you enter into retirement, Education Planning (for yourself or your children) needs to occur well before mature learners or young scholars are poised to embrace higher education.

Estate Planning

Having an estate plan is paramount in ensuring your estate is handled according to your wishes. Together with your estate planning attorney, we can assist in drafting documents and reviewing your situation so your estate benefits the people and charities you care about most.

Meet Your Advisor

We manage assets for individuals and families, providing investment management, and financial planning services.

Blogs

How much do you need to retire wealthy? Believe it or not, there’s no set number for anyone.

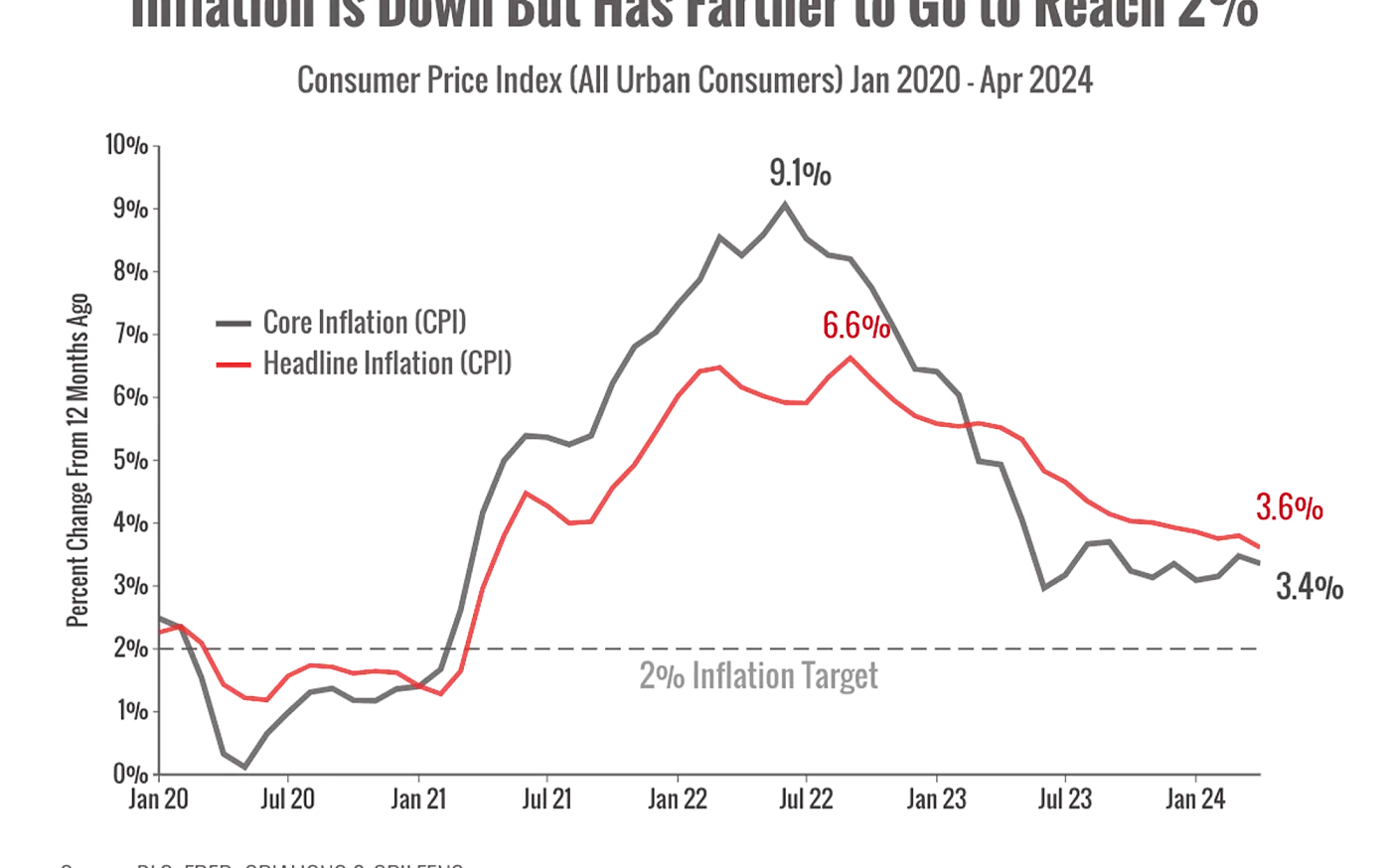

After months of simmering inflation reports, it looks like inflation finally eased slightly in April. Are prices stabilizing? Let’s dig a little deeper.

How many years will your retirement last? Most of us answer those questions wrong because we don’t have strong longevity literacy.